2026 Skynet Prediction Markets Report

DOWNLOAD the full report here!

Executive Summary

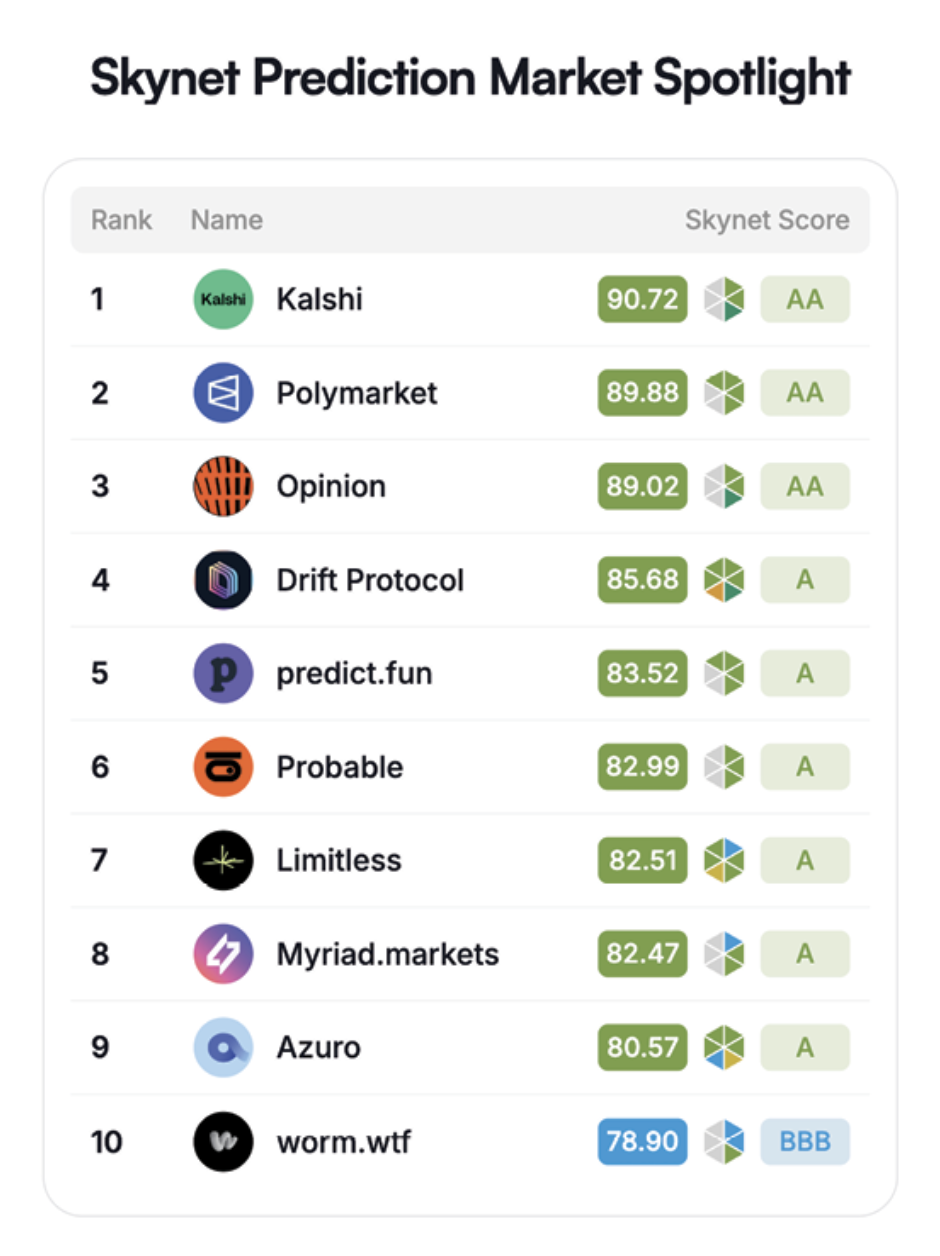

Prediction markets crossed into the mainstream in 2025, with annual trading volume growing 4x and a small number of dominant platforms emerging. Kalshi, Polymarket, and Opinion now control the vast majority of global volume, each pursuing distinct regulatory and technical strategies.

This growth brings increased security exposure. The sector experienced a third-party security incident in December 2025 when an authentication provider for Polymarket was compromised. On-chain platforms face persistent risks from oracle manipulation, admin key vulnerabilities, and front-running. Wash trading remains widespread, with research estimating that artificial volume reached 60% on some platforms during peak airdrop farming periods.

Regulatory fragmentation adds complexity. Following Kalshi’s CFTC victory, prediction markets became legal financial products in the United States. However, multiple EU countries have banned Polymarket as unauthorized gambling. State-level restrictions in the US threaten to create a patchwork of compliance requirements, even where federal law is clear.

The platforms that survive will be those that solve three problems simultaneously: maintaining liquidity across fragmented jurisdictions, demonstrating security infrastructure sufficient for institutional capital, and building sustainable revenue models that don't depend on incentive-driven volume.

Key Takeaways

In this report, we cover the following topics and more:

- The December 2025 security incident involving Polymarket’s third-party provider shows that hybrid Web2/Web3 architectures introduce centralized failure points, even when smart contracts remain secure.

- Prediction markets are legal financial products in the US, but banned as unauthorized gambling in multiple EU countries, with state-level restrictions threatening to further balkanize even favorable federal jurisdictions.

- Research estimates that artificial volume reached 60% on some platforms during airdrop farming peaks, distorting liquidity metrics, while probability outputs remained reliable for forecasting.

- Most protocols retain administrative controls for pausing markets and upgrading contracts, creating single points of failure that contradict decentralization claims.

- Market resolution mechanisms directly control fund distribution, and ambiguous market definitions have already caused disputes across all major platforms throughout 2025.

- Prediction markets are evolving into infrastructure for pricing uncertainty across domains. Key features include micro-markets, AI trading agents, event hedging, supply chain, parametric insurance, and distribution integration, depending on the particular sector.

- In 2026, we anticipate that additional jurisdictions will establish prediction markets, there will be significant technical improvements such as privacy enhancements, and institutional adoption of prediction markets will accelerate.

Skynet Prediction Market Spotlight: Top 10 Projects

This assessment is based on CertiK's Skynet Top Board evaluation framework. Unlike conventional rankings that primarily rely on market capitalization or trading volume, the Skynet Top Board focuses on a project's overall risk profile and long-term resilience within a specific sector. It evaluates a broad set of signals—including code security, fundamental health, operational resilience, community trust, governance strength, and market stability—to help distinguish projects that not only perform well in the short term, but also demonstrate the structural strength needed for sustainable, long-term growth.

Read the full report to learn more about prediction market statistics, emerging platforms, and the potential for future adoption.

FAQs

Are prediction markets legal in 2025?

Status is currently fragmented: markets are legal financial products in the US following CFTC rulings, but banned as unauthorized gambling in multiple EU nations.

How much wash trading is on prediction markets?

Regarding market integrity, CertiK's data estimates that artificial volume reached 60% on some platforms during airdrop farming peaks, significantly distorting liquidity metrics while probability outputs remained largely reliable.

What are the security risks for prediction markets?

Hybrid Web2/Web3 architectures create centralized failure points, as highlighted in our report, evidenced by the December 2025 incident involving a compromised third-party authentication provider.

What is the future of prediction markets in 2026?

CertiK's research anticipates accelerated institutional adoption and technical privacy enhancements in 2026, though platforms must navigate increasing state-level restrictions that threaten to further complicate the global compliance landscape.